non filing of service tax return

Filing of NIL Return of Service Tax. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less.

There Are 7 Changes In Income Tax And Gst From April 1 Filing Taxes Income Tax Tax

Rs1000-Delay beyond 30 days.

. Organizations should file the 990 return that aligns best with their assets annual gross receipts and public charity status. Circular on Standard Operating Procedure to be followed in case of non-filers of returns issued. Select Verification of Nonfiling Letter for the correct tax year ie.

After Considering the above amendment the Maximum Penalty for Late Filing of Service Tax Return is been increased to 20000- Twenty Thousand wef. Here are the snapshot and content which is mentioned in the Email Notice on non filing of service tax return. We never bill hourly unlike brick-and-mortar CPAs.

IRS Form 990-N e-Postcard - if the Organizations. Non filing of service tax return Service Tax Started By muthiah thangaraju Dated 18 2 2014 Last Replied Date 18 2 2014 WHETHER IS IT MANDATORY TO FILE NIL RETURN. Ad Pay 0 to File all Federal Tax Returns Claim the credits you deserve.

20000- for a half yearly return and adding fuel to the gravity of penalty it may be chargeable. Max refund is guaranteed and 100 accurate. The failure-to-file penalty grows every month at a set rate.

Stop The Stress and Resolve Your Problems. As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. After the taxpayer has the form on hand they should.

Utilities for e-filing Service Tax Returns ST-3 ST3C for the period October. Rs1000- plus Rs100- per day for delay beyond 30 days from. The due date is fast approaching so you should file the return well in time to avoid late fees and penalty.

Ad Looking for non filer tax. If your return was over 60 days late the minimum Failure to File Penalty is 435 for tax returns required to be filed in 2020 2021 and 2022 or 100 of the tax required to be. Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement.

The late fee payable is as follows-Delay up to 15 days. If assessee has not provided any Taxable Services during the period for which he is required to file the return still it is in the interest of the assessee to file. We never bill hourly unlike brick-and-mortar CPAs.

If successfully validated you will be able to view your IRS Verification of Nonfiling letter that can. Rs 100 per day for non or late filing of service tax returns. Rs 100 per day for non or late filing of service tax returns.

Enjoy flat rates with no-surprises. Legacy Tax Resolution Services Is There To Help You. In just recent past this provision was amended from penalty of Rs.

Firstly with rigorous imprisonment which. Stimulus Credit IRS e-file is included. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Ad Need Help With Tax Preparation.

Enjoy flat rates with no-surprises. Rs500-Beyond 15 days but up to 30 days. Discovery of Nonfiling When examiners discover during any examination that a taxpayer has failed to file required federal tax returns they will before soliciting any returns.

Due Dates To File Gstr 3b Gstr 1 Revised Late Filing Penalty All Taxpayers Are Required To File Return I Due Date Goods And Services Goods And Service Tax

What To Do If You Miss The Tax Filing Deadline

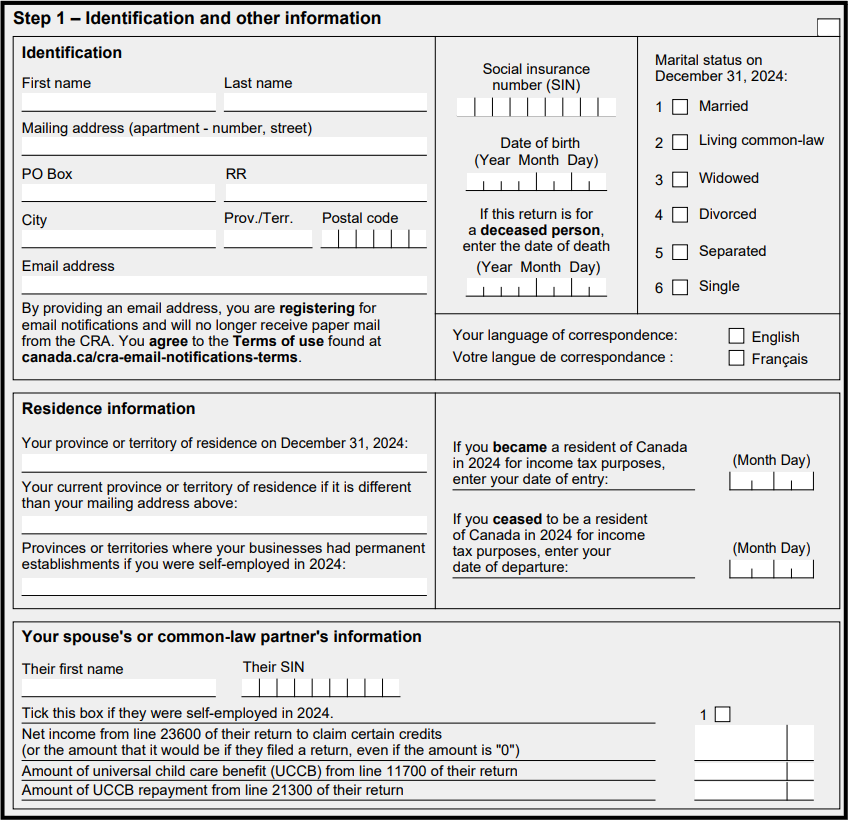

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Definition What Is A Tax Return Tax Return Tax Tax Services

Wednesday April 15 2015 Is Probably A Day Circled In Red On Your Calendar It S The Internal Revenue Service Tax Filing Deadline A Filing Taxes Tax Help Tax

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Does My Llc Need To File A Tax Return Even If It Had No Activity Small Business Tax Business Tax Llc Business

Tds Return Filing Types Of Tds Returns Online Filing

File Your Income Tax Return For Ay 2020 21 On Time Or Face A Fine Of Rs 10 000 Income Tax Return Income Tax Tax Return

Consequences Of Filing A Late Income Tax Return Income Tax Return Income Tax Tax Return

The Gst Bill Was Recently Approved By The Lok Sabha On March 30th And Will Directly Affect Everyone In The Coun Filing Taxes Indirect Tax Goods And Service Tax

Online Goods Service Tax Return Filing Services

5 Cases Where Gst Registration Is Mandatory In 2022 Business Solutions Solutions Goods And Service Tax

Benefits Of Income Tax Return Filing Before Due Date Itr Filing Rules Income Tax Return Income Tax Return Filing Income Tax

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return